Management Liability

Management liability insurance policies offer liability cover for company managers to protect them from claims which may arise from the decisions and actions taken within the scope of their regular duties.

Any allegations of wrongdoing need to be investigated and defended, and this can cost a significant amount even if the case doesn’t reach court. This means directors’ and officers’ personal finances are at risk, so it’s essential companies provide protection through management liability insurance.

Why are individuals so vulnerable?

- Employees are increasingly likely to sue

- Legal liability is shifting towards personal liability

- Regulators are now more proactive in investigating companies

If a director or officer is perceived to have failed in any of their duties, then a claim could come from any number of third party sources

Let us call you back

Why YOU need management liability insurance?

It’s essential for companies looking for external funding

It’s common for investors interested in a company to make D&O insurance a must-have requirement. This protects directors and officers from allegations of mismanagement. D&O cover provides protection against legal action, fines, penalties, and disqualifications from being a director.

It provides protection from three angles

D&O cover provides three-sided protection. One side covers directors personally for fines, penalties and legal expenses. The second reimburses the company for paying on behalf of the directors. And the last covers the company should it itself be named in the lawsuit.

Professional indemnity cover isn’t enough on its own

It’s a common misconception that personal liability claims are covered under professional indemnity, but this is unlikely. A separate D&O policy is the only way to guarantee personal protection for those with management responsibility in your business.

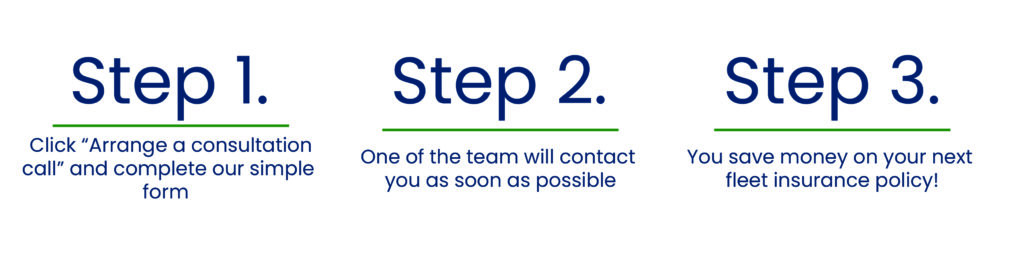

How to get a cheap fleet insurance quote

Why does your company need directors and officers insurance?

Because you can face frivolous and occasionally malicious claims made by disgruntled customers who aren’t happy about the service they received, all the way through to official investigations.

Claims and proceedings where personal liability can be involved also typically include:

- Investors and shareholders who blame directors personally for losses

- Actions brought by liquidators, where they suspect wrongful trading

- HSE investigations where negligence is suspected

- Police and SFO investigations where fraud is suspected

- Actions brought by shareholders, creditors & regulatory bodies

- Claims by employees, auditors, liquidators, customers and suppliers

- Claims by HMRC where insolvent trading or misappropriation of tax payments is suspected

Management Liability Insurance FAQ's

It’s there to protect you financially against any claims made against you personally as a director, partner or officer of your business. From health and safety concerns to a claim for breach of duty, negligence, defamation or even pollution, our insurance will cover you against the costs of defending or settling legal or criminal actions.

It would be great if you could predict when something might trigger legal action or a claim for compensation against you. But you can’t, so it’s a good idea to have insurance no matter what type of business you’re in. It’s better to know you’re protected against any legal costs, fines or compensation claims made against you than to face the financial burden yourself.

The level of cover you need will depend on what you do for a living and the kinds of risks you’re likely to be exposed to. We can cover you from £100,000 to £10 million but your policy is as personal to you as your job is. We’ll work with you to figure out exactly what you need and we’ll tailor your policy to your sector and your role.

If you have shareholders that own 15% or more of the company, then check for a “major shareholder exclusion” – this effectively excludes any claim brought by a shareholder against the business that owns 15% or more of the company’s shares. And should you have shareholders, business activities or contracts, make sure your jurisdiction allows for worldwide claims. Another thing is to make sure your limit is high enough, as many D&O plans have an aggregate limit, meaning another director/officer could use it up, should a claim be made – leaving you exposed.

Would you like to find out more?

Contact us today for any questions not answered!