Cyber Insurance

Cyber and data risks insurance, also known as cyber liability insurance, is designed to support and protect your organisation if it experiences a data breach or malicious cyber hack that affects your systems or ability to operate.

Let us call you back

You should consider cyber insurance if you:

Store personal information

Use a computer

Take card payments

Have a website

Keep email addresses

Run business software

Make electronic payments

Use cloud storage

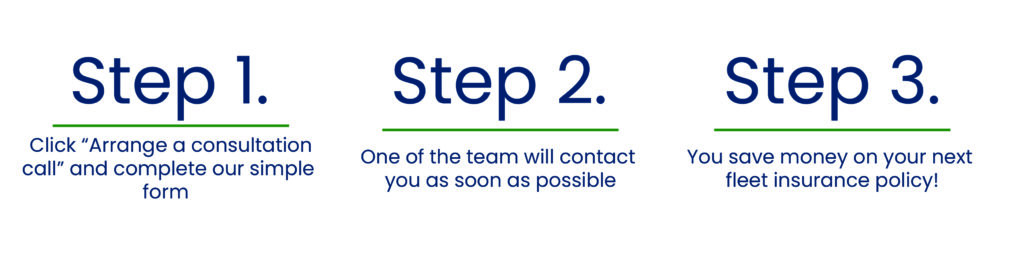

How to get a cheap fleet insurance quote

What if...

If your business handles customer data or processes payment transactions, you’re at risk of a cyber attack. Expenses associated with a data breach can quickly add up for a small business. Whether you have 300 customer records or 3000, your bottom line could be impacted by legal defense costs, settlements, lost business, notification costs, and more.

We provide access to 24/7 specialists that can help you through the breach providing technical, forensic and legal assistance.

If your primary business operations require the use of computer systems, a disaster that cripples your ability to transmit data could cause you, or a third party, a reduction in turnover. Loss of turnover due to a server failure following a data breach can affect your day-to-day operations.

Time and resources that normally would have gone elsewhere will need to be directed towards the problem, which could result in further losses. This is especially important as denial of service attacks by hackers has been on the rise.

Such attacks block access to certain websites by ether rerouting traffic to a different site or overloading an organisation’s server and this part of the policy is designed to bring you back to pre-loss revenue levels.

Frequently Asked Questions

Cyber incidents now happen very often to all businesses and will only increase. The coverage we provide works to maximise your data protection and business security.

Fact

Almost 9 in 10 SMEs say their cyber insurance covered the cyber security incidents they suffered in 2018.

What businesses should buy data insurance?

In truth, no organisation is immune from the potentially devastating financial impacts of a cyber loss. Any business that relies upon technology to acquire or engage with customers, processes or stores customer data could seriously suffer as a result of data loss or theft.

Cyber insurance helps protect your business and customers digital data

- Introduce a mandatory notification period following a data breach of 72 hours.

- Greatly increase the potential penalties for non-compliance to 4 of global turnover of EUR 20 million, whichever is greater.

- Clearly defines the rights of individuals over the personal data held on them by all organizations.

If your business handles customer data or processes payment transactions, you’re at risk of a cyber attack. Expenses associated with a data breach can quickly add up for a small business when the average cost of each compromised record is £200. Whether you have 300 customer records or 3,000, your bottom line could be impacted by legal defense costs, settlements, lost business, notification costs, and more.