Liability

Public and Employers liability

Public Liability

Covers your legal liability for injury or damage to the property of other people. This could be customers, workman on site or members of the public when you are out delivering goods.

Employers Liability

Your legal responsibility to your workers if they are injured including labour only subcontractors. This is a compulsory insurance for any employer with employees.

Let us call you back

What do I need employers liability insurance for?

Protection from workplace risks

It’s easy to worry about workplace accidents and illnesses when you’re leading a team of any size. And while you can put as many health and safety measures as you can in place, accidents can still happen.

If an employee suffers from a work-related injury or illness and wants to make a claim against you, employers liability insurance would cover the legal and compensation costs associated with the claim.

Because it’s a legal requirement

Employers liability insurance is a legal requirement in the UK. If you were found to have employees, but no employers liability policy in place, you could be fined £2,500 from the Health and Safety Executive (HSE) for every day that you didn’t have cover.

Once you have EL cover, it’s also a legal requirement to display your policy certificate, either online or on your business’ premises. If you didn’t, the HSE has the power to fine you £1,000.

Cover from ‘compensation culture'

There has been a steep rise in ‘no win, no fee’ services over the last few years. These services make it easy for employees to make a claim against you, even if your company isn’t to blame. Employers’ liability insurance protects you from these kinds of claims.

Peace of mind

Accidents are largely out of your control, which can be a worrying thought. But employers liability cover is there to ease those worries with cover that protects you and your business from the potentially high costs of a lawsuit and payout, if an employee tried to claim compensation.

What do I need public liability insurance for?

Accidental damage and injury claims

Public liability insurance is designed for claims made by third parties in relation to accidental injury or property damage as a result of your business.

Legal expenses and compensation cover

If a claim is made against you, public liability will cover the legal fees and compensation costs associated with the claim, including court appearances and defence fees.

Multiple cover options

Choose from £1m, £2m or £5m of public liability cover. If you find that you have too little or too much cover for the type of work you do, you can change the level of cover you have through your online account, free of charge.

Employee injury

If an employee was injured as a result of your business or while working for you, this would not be covered by public liability insurance.

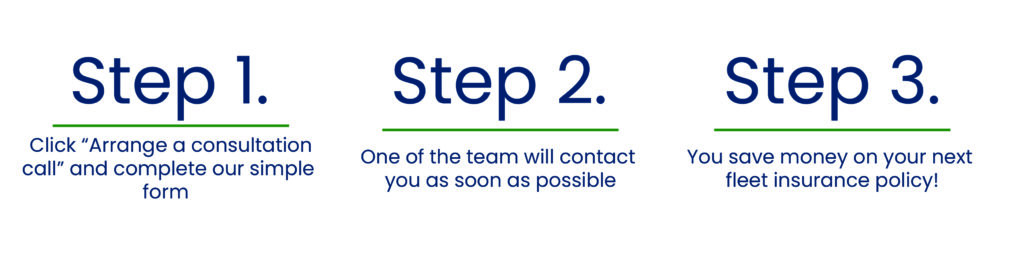

How to get a cheap fleet insurance quote

Public liability insurance FAQ's

Public liability insurance covers legal and compensation costs in relation to a claim against your business from a member of the public – whether it’s a customer, supplier or contractor (basically anyone who isn’t an employee). It’s an important cover for all businesses to consider – freelancers included.

Although public liability insurance isn’t a legal requirement in the UK, it’s something that most businesses consider, as most SMEs can’t afford the risk of paying a large claim.

Furthermore, if you’re working with other companies, many will insist on you having public liability cover. So you could also be at a competitive disadvantage if you don’t have it. Some bigger clients, particularly government contracts, may request a minimum of £5 million or even £10 million in cover.

We can offer various limits, £1m, £2m or £5m but can go to higher if your customer needs more. These can be changed at any time during the policy.

Public liability does not cover claims from employees against your business. To cover yourself for these, you’ll need employers liability insurance, which is a legal requirement in the UK, for all companies with employees.

While public liability covers compensation and legal costs if you’re sued by a member of the public for injury or damage, professional indemnity insurance covers compensation and legal costs if you’re sued by a client for a mistake that you make in your work

Public liability isn’t mandatory by law in the UK. However, the unexpected costs of a claim against your business could be devastating, so it’s important to weigh up the relatively small cost of public liability versus the potentially devastating costs associated with a claim.

Accidents happen. Whether it’s a slip, trip, fall or someone injuring themselves using your equipment – it could lead to a lawsuit. There are many ‘no win, no fee’ services these days, which means you can still face a liability or compensation claim even if it wasn’t your fault. Public liability protects you should a claim be made.

Employers liability insurance FAQ's

Employers liability insurance provides cover for legal and compensation costs associated with a claim made against you by an employee, due to injury or illness.

Employers liability insurance protects businesses if an employee makes a claim due to workplace injury or illness. It covers the legal and compensation costs associated employee claims.

Employers liability insurance is mandatory in the UK for all businesses employing one or more people. This makes is an essential cover for more businesses.

Employers liability claims can arise for a number of situations. From posture issues due to uncomfortable seating, to broken bones from falls, to mental health issues caused by immense stress. Any work situation which causes an employee’s injury or damage to their personal property may result in a claim against you.

Would you like to find out more?

Contact us today for any questions not answered!